SOUTH FLORIDA

Home Sales Down, Average Price Up

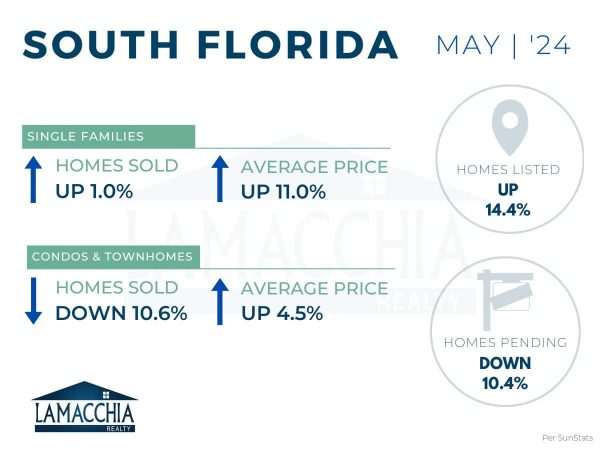

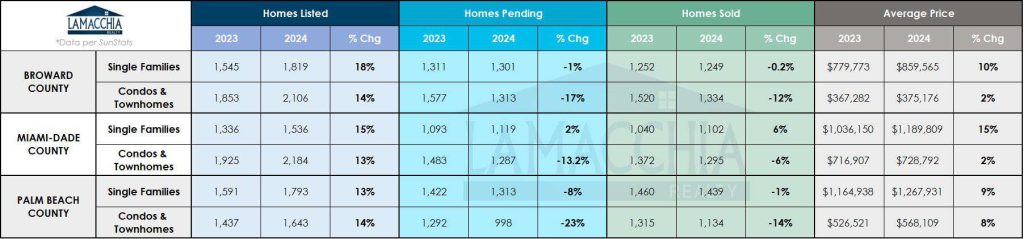

Home sales are down 5.1% year over year, with May 2024 at 7,553 compared to 7,959 last May. Sales are up for single-family homes, and down for condos & townhomes.

- Single families: 3,752 (2023) | 3,790 (2024)

- Condos & Townhomes: 4,207 (2023) | 3,763 (2024)

Average sale price increased 10.8% year-over-year, now at $833,704 compared to $752,474 in May 2023. Prices increased across all categories.

- Single families: $1,000,627 (2023) | $1,110,472 (2024)

- Condos & Townhomes: $531,159 (2023) | $554,951 (2024)

Homes Listed For Sale:

The number of homes listed is up by 14.4% when compared to May 2023.

- 2024: 11,081

- 2023: 9,687

- 2022: 12,438

Pending Home Sales:

The number of homes placed under contract is down by 10.4% when compared to May 2023.

- 2024: 7,331

- 2023: 8,178

- 2022: 9,185

Data provided by SunStats then compared to the prior year.

What’s happening in the market?

In May, we saw the continuation of trends we have been seeing over the last few months in the South Florida housing market. Inventory is up 62% year over year – mostly influenced by the inventory of condos & townhomes which is up 73.4% year over year compared to 44.7% for single family homes. New listings are outpacing the number of sales in South Florida, and pending sales are down, meaning homes are being listed faster than they are going under agreement. The resulting increase in inventory from the aforementioned factors and generally lower buyer activity in the market has translated to homes sitting on the market longer and many homes have required a price adjustment as a result.

All the while, mortgage rates continue to ebb and flow, and greatly impact the decision-making of both buyers and sellers. Specifically for buyers and sellers in South Florida, increasing mortgage rates strain affordability even more so than in other parts of the country given the rapid increase in insurance premiums and added special assessment fees for condos in the area.

What does this mean for Buyers?

For buyers, more inventory means more options, increased leverage, and potentially less competition, especially when compared to the frenzied state of the market during the early pandemic years. As inventory continues to increase, we could see a stabilization or eventual reduction in home prices. In fact, although average sale price in South Florida for single family homes is still trending upwards, the average sale price for condos & townhomes decreased by 5% from last month. The market in South Florida has changed, so buyers need to recognize this, and know that if a home has been sitting on the market or has had a price adjustment, there is nothing “wrong” with that home, this is just the market now!

Despite the prevalence of cash sales in the South Florida market, mortgage rates still create affordability concerns for buyers, particularly first-time buyers. In May, per Mortgage News Daily, mortgage rates started high but then came down to just under 7 in the middle of the month before cruising back up to the low 7s toward the end. Buyers need to be ready and informed of all their financing options so they are ready to take advantage of the opportunities the summer will bring!

What does this mean for Sellers?

Condos & townhomes are being listed faster than they are going under agreement which is greatly contributing to the rise in inventory levels we are currently seeing. First, current condo owners are bearing the costs of increased regulations in the form of special assessments, higher HOA fees, increased cost of homeownership insurance, etc. As such, many current condo & townhouse owners are opting to list their properties rather than pay these additional costs. Then, for prospective buyers, these increased costs put many condo associations outside of their budget as they are facing other strains on affordability such as increased mortgage rates, increased average sale price, etc. Therefore, we will see more and more price adjustments for condos & townhomes due to lower buyer demand and also longer time on market.

As we have seen over the last several months, sellers are no longer able to simply name their price for their home, and sell it within a matter of days. The market has changed and sellers need to understand that as more homes get put on the market (many because sellers are no longer able to delay unavoidable life changes), they will face more competition, especially with a dwindling number of buyers out in the market. Therefore, pricing your home competitively has never been of more importance. This will ensure you generate the most demand for your home which will ultimately help to make sure you get the most money for your home and reduce the chance of it sitting on the market.

What’s next?

We expect to see a continuation of the market trends discussed in this report as we head further into the summer months. Mortgage rates will continue to play a crucial role as well as each change, up or down, impacts the decision-making of both buyers and sellers, especially when paired with other strains on affordability (e.g., insurance premiums and special assessments) for South Florida specifically. While many are waiting for a significant “drop” in mortgage rates, current market trends suggest that these rates may hold steady for the foreseeable future and become the new “normal”. Ultimately, completing your real estate goals should be done when it is right for YOU! Remember, refinancing is often an option for homeowners should rates become more favorable in the future.