MAINE

Home Sales Up, Average Price Up

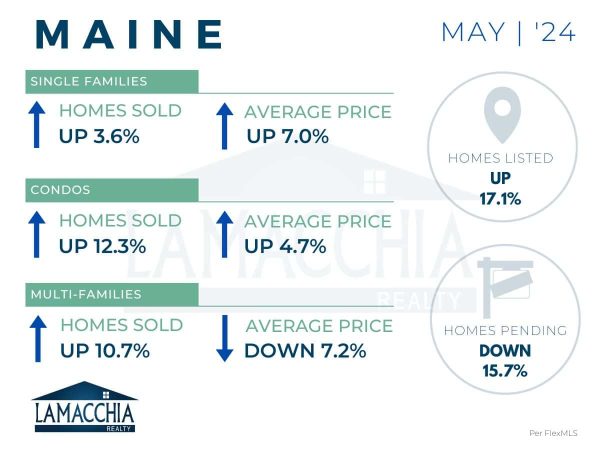

Home sales are up 5% year-over-year, with May 2024 at 1,463 compared to 1,393 last May. Sales are up across all categories.

- Single families: 1,146 (2023) | 1,187 (2024)

- Condominiums: 163 (2023) | 183 (2024)

- Multi-families: 84 (2023) | 93 (2024)

Average sale price increased 5.8% year-over-year, now at $498,174 compared to $471,085 in May 2023. Prices are up for single-family homes and condos, but they are down for multi-family homes.

- Single families: $467,774 (2023) | $500,366 (2024)

- Condominiums: $473,302 (2023) | $495,690 (2024)

- Multi-families: $511,954 (2023) | $475,083 (2024)

Homes Listed For Sale:

The number of homes listed is up by 17.1% when compared to May 2023.

- 2024: 2,680

- 2023: 2,288

- 2022: 2,846

Pending Home Sales:

The number of homes placed under contract is down by 15.7% when compared to May 2023.

- 2024: 1,391

- 2023: 1,650

- 2022: 2,071

Data provided by FlexMLS then compared to the prior year.

What’s Happening in the Market?

The housing market data in May for Maine showed signs of a changing market, and we expect this to continue as the summer months roll on. As the year progresses, more and more sellers put their homes on the market. At the same time, many buyers have either already found homes or have given up on their search and decided to rent for another year. With more homes available, buyers have more choices, making pricing increasingly important for sellers. All the while, mortgage rates continue to ebb and flow, and greatly impact the decision-making of both buyers and sellers.

What does this mean for Buyers?

Earlier in the year, there was less inventory as sellers hesitated to list their homes, and buyers were out in droves leading to intense competition and bidding wars. Now, the summer is a great time for buyers as more sellers are listing their homes which is increasing inventory. At the same time, a lot of serious buyers who were in the market before have either found a home or have decided to rent for another year, leading to a break in the intense level of competition in the market. However, there are several benefits to homeownership, so there is still plenty of buyer demand in the market.

Average sale price in Maine continues to climb, but as inventory continues to increase, this should help to slow price growth. Mortgage rates also create affordability concerns for buyers. In May, per Mortgage News Daily, mortgage rates started high but then came down to just under 7 in the middle of the month before cruising back up to the low 7s toward the end. Buyers need to be ready and informed of all their financing options so they are ready to take advantage of the opportunities the summer will bring!

What does this mean for Sellers?

As we head further into the summer market, sellers need to understand that as more homes get put on the market, that means they will face more competition, especially with a dwindling number of buyers out in the market. We will most likely see homes start to sit on the market longer, leading to price adjustments. With this in mind, pricing competitively right at the start will be crucial for sellers to generate the most demand for their homes and reduce the chance of them sitting on the market. Generally speaking, homes will not sell for as much as they did at the beginning of the year when inventory was tight and buyers were out in droves leading to bidding wars, so being realistic and informed when pricing your home will help set you up for success this summer!

What’s next?

As more and more sellers continue to list their homes, inventory will continue to increase, giving buyers a much-needed reprieve from the intense competition they have been facing. For sellers, being aware of this shift and pricing your home accordingly will be crucial to attract serious buyers thus preventing your home from sitting on the market or needing a price adjustment.

Mortgage rates will continue to play a crucial role as summer rolls on as each change, up or down, impacts the decision-making of both buyers and sellers. While many are waiting for a significant “drop” in mortgage rates, current market trends suggest that these rates may hold steady for the foreseeable future and become the new “normal”. Ultimately, completing your real estate goals should be done when it is right for YOU! Remember, refinancing is often an option for homeowners should rates become more favorable in the future.